Institut talabalari olgan nazariy bilimlarini amaliyotda qo'llashi bilan mustahkamlashadi

- Institut yangiliklari

- E'lonlar

- Rekvizitlar

- Ilm-fan

- Anticor

- eco faol talabalar

- Yashil universitet

Uzbek

- Institut yangiliklari

- E'lonlar

- Rekvizitlar

- Ilm-fan

- Anticor

- eco faol talabalar

- Yashil universitet

So'nggi yangiliklar

🌟 "Dolzarb 90 kun" loyihasi doirasida talabalar Toshkent shahrining diqqatga sazovor joylariga sayohat qilmoqdalar

Jun 16 2025

🌟 "Dolzarb 90 kun" loyihasi doirasida Dekan kubogi musobaqasi tashkil etildi

Jun 16 2025

🌟 “Dolzarb 90 kun” loyihasi doirasida talabalar uchun Toshkent shahriga tashkil etilgan sayohat davom etmoqda

Jun 16 2025

🌿 Talabalar Toshkent Botanika bog‘ining ilmiy laboratoriyalariga tashrif buyurdilar

Jun 16 2025

60 dan ortiq xorijiy universitetlar va xalqaro fondlar bilan hamkorlik shartnomalari institutda ilg'or tajribalarni joriy qilish orqali ta'lim sifatini va institutning reyting ko'rsatkichlarini oshirishga xizmat qiladi

Biz haqimizda

Аndijon qishloq xoʼjaligi va agrotexnologiyalar instituti Oʼzbekiston Respublikasi qishloq va suv xoʼjalik tarmoqlari uchun yuqori malakali mutaxassislar tayyorlaydigan yirik oliy taʼlim muassasalaridan biridir

Batafsil ma'lumot

Yo'nalishga mos bo'lgan laboratoriya xonalaridan bilim olishda unumli foydalanish talaba malakasi va ko'nikmalarini oshiradi

Sholi ko'chatlarini ekuvchi mashinaning sanoat nusxasini yaratish

Takroriy tajribalar - yuqori aniqlik kafolatidir.

Robotexnikani qishloq xo'jaligida qo'llash

E'lonlar

📷 “Mening samarali ta’tilim” – fotosuratlar tanlovi oʻtkaziladi

16 Jun, 2025

16 Jun, 2025

📚 "Zukko kitobxon" intellektual o‘yiniga start berildi!

16 Jun, 2025

16 Jun, 2025

“Traktorchi-mashinist” guvohnomasi o‘quv kursi

16 Jun, 2025

16 Jun, 2025

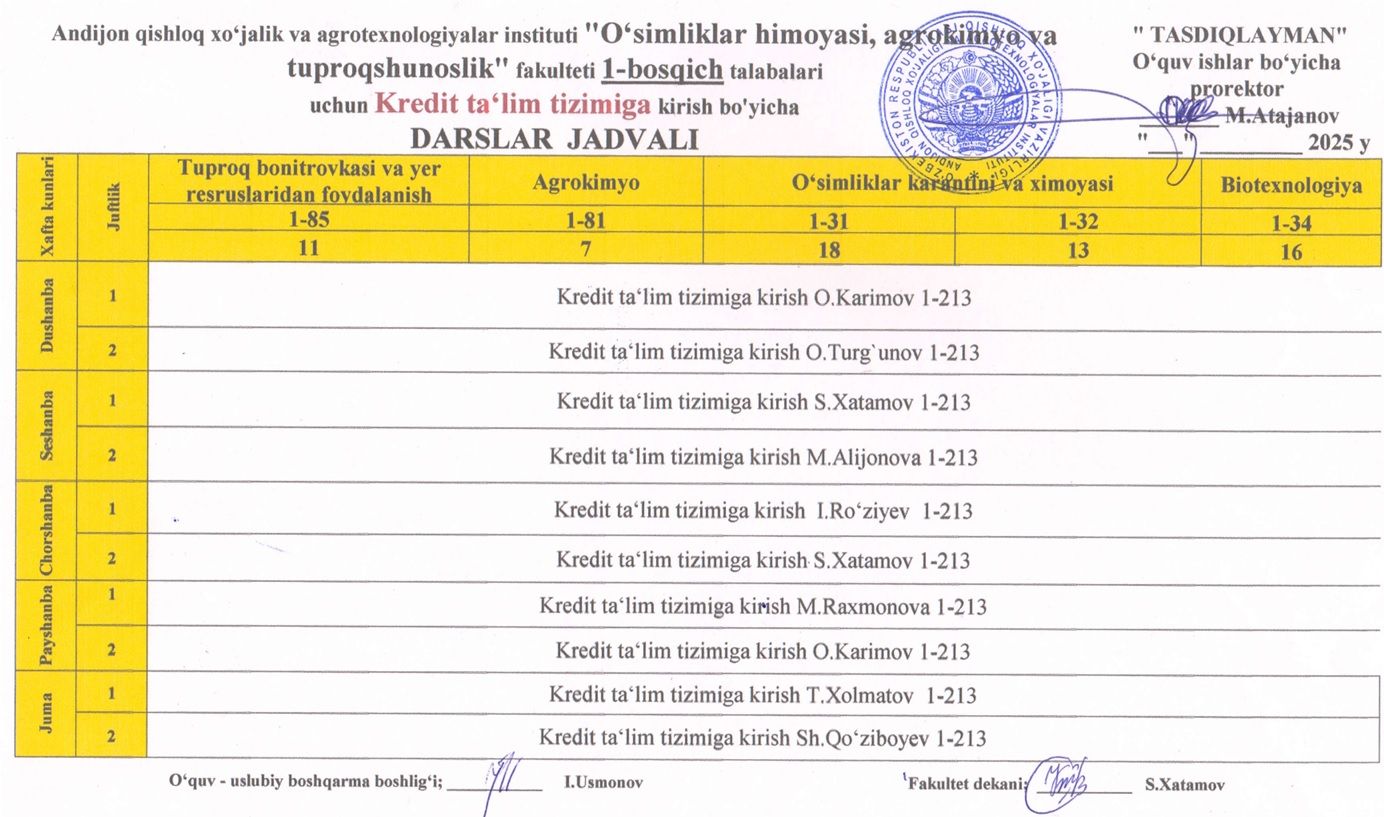

Kredit tizimiga kirish jadvali

15 Jun, 2025

15 Jun, 2025

©2024 The University of ANDQXAI